A Detailed Summary of Secured Credit Card Singapore Options for Improved Credit Control

A Detailed Summary of Secured Credit Card Singapore Options for Improved Credit Control

Blog Article

Introducing the Possibility: Can People Discharged From Insolvency Acquire Credit History Cards?

Understanding the Effect of Bankruptcy

Upon declare personal bankruptcy, people are faced with the significant effects that penetrate various facets of their economic lives. Bankruptcy can have an extensive influence on one's credit history rating, making it challenging to accessibility credit rating or lendings in the future. This monetary stain can remain on debt reports for a number of years, impacting the individual's capability to protect positive passion prices or monetary chances. In addition, personal bankruptcy might result in the loss of properties, as certain possessions might need to be sold off to pay off financial institutions. The emotional toll of personal bankruptcy must not be ignored, as individuals may experience sensations of shame, pity, and tension because of their financial circumstance.

Additionally, personal bankruptcy can limit employment opportunities, as some employers carry out credit report checks as component of the working with process. This can posture a barrier to individuals seeking brand-new job leads or career improvements. In general, the impact of personal bankruptcy extends past economic restraints, affecting numerous aspects of a person's life.

Elements Impacting Credit Scores Card Authorization

Adhering to personal bankruptcy, people usually have a low credit rating rating due to the negative impact of the insolvency filing. Credit card firms usually look for a credit rating score that demonstrates the applicant's capability to take care of credit history properly. By meticulously taking into consideration these factors and taking steps to rebuild credit history post-bankruptcy, people can improve their prospects of obtaining a debt card and working in the direction of financial recovery.

Steps to Rebuild Debt After Insolvency

Rebuilding credit report after bankruptcy calls for a tactical technique concentrated on economic technique and regular debt administration. The initial step is to evaluate your credit score record to make certain all financial obligations included in the insolvency are precisely reflected. It is vital to establish a spending plan that prioritizes financial obligation settlement and living within your methods. One reliable approach is to acquire a secured bank card, where you deposit a specific amount as collateral to develop a credit rating limit. Timely repayments on this card can show liable credit report usage to possible lenders. Furthermore, take into consideration becoming a licensed user on a family members member's charge card or discovering credit-builder fundings to additional enhance your credit scores rating. It is critical to make all payments on time, as settlement history significantly influences your debt score. Patience and perseverance are crucial as rebuilding credit rating takes time, yet with devotion to sound financial methods, it is possible to improve your credit reliability post-bankruptcy.

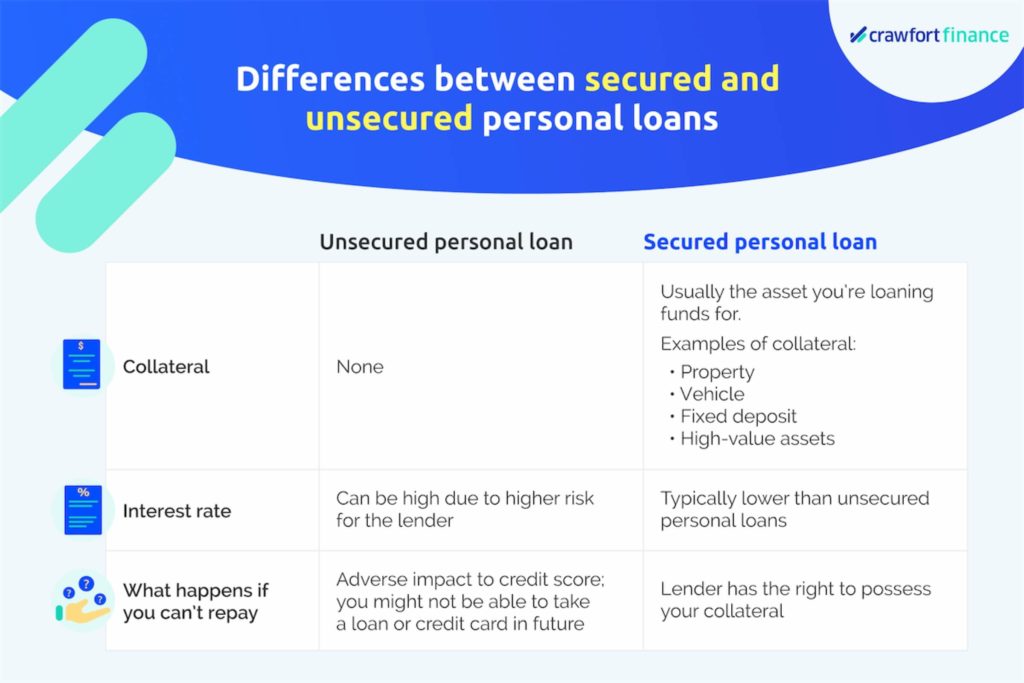

Safe Vs. Unsecured Credit History Cards

Adhering to personal bankruptcy, individuals commonly think about the selection in between safeguarded and unsecured charge card as they aim to reconstruct their credit reliability and economic security. Secured bank card call for a money down payment that serves as collateral, typically equivalent to the credit line approved. These cards are simpler to get post-bankruptcy considering that the down payment lessens the danger for the provider. However, they may have higher charges and rate of interest contrasted to unprotected cards. On the other hand, unsecured charge card do not need a deposit but are more difficult to receive after insolvency. Providers assess the candidate's creditworthiness and may supply reduced costs and rate of interest go to this web-site rates for those with a good monetary standing. When making a decision between both, people ought to consider the benefits of easier approval with protected cards against the potential costs, and think about unsafe cards for their lasting monetary objectives, as they can aid restore debt without locking up funds in a deposit. Inevitably, the choice in between protected and unsecured charge card must line up with the person's monetary purposes and capability to manage credit score sensibly.

Resources for People Seeking Credit Rating Restoring

For individuals aiming to improve their credit reliability post-bankruptcy, exploring offered sources is vital to efficiently navigating the credit rating rebuilding procedure. secured credit card singapore. One beneficial resource for individuals seeking debt rebuilding is credit history therapy companies. These organizations provide financial education, budgeting assistance, and personalized credit report renovation plans. By working with a credit rating counselor, individuals can gain insights into their credit score records, find out approaches to increase their credit ratings, and get advice on managing their financial resources efficiently.

Another valuable source is credit report monitoring solutions. These services permit individuals to maintain a close eye on their credit records, track any type of inaccuracies or changes, and hop over to these guys identify possible indications of identity theft. By checking their debt regularly, individuals can proactively resolve any issues that might ensure and arise that their credit history details depends on day and precise.

Furthermore, online tools and resources such as credit report simulators, budgeting apps, and monetary literacy web sites can provide individuals with important information and tools to assist them in their credit restoring journey. secured credit card singapore. By leveraging these resources successfully, people released from bankruptcy can take purposeful actions in the direction of boosting their credit health and wellness and securing a far better economic future

Final Thought

To conclude, individuals released from insolvency might have the opportunity to obtain charge card by taking actions to imp source restore their credit score. Elements such as debt revenue, debt-to-income, and background proportion play a substantial role in charge card approval. By comprehending the impact of bankruptcy, choosing in between safeguarded and unprotected credit score cards, and making use of resources for debt rebuilding, people can enhance their creditworthiness and possibly get accessibility to charge card.

By working with a credit score counselor, people can obtain understandings right into their credit rating reports, find out techniques to increase their credit rating ratings, and receive assistance on managing their funds successfully. - secured credit card singapore

Report this page